Data quality woes

Inconsistent, inaccurate and incomplete data leading to faulty financial reporting and delay in reconciliation proces.

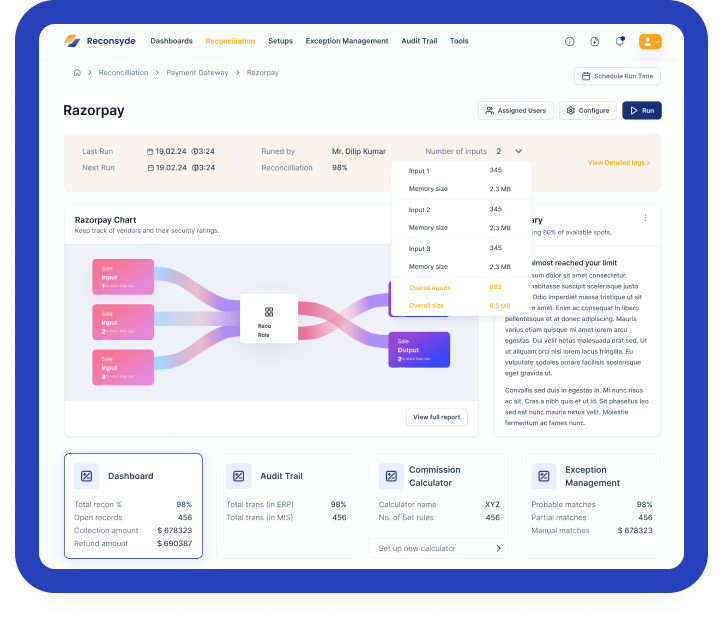

Our PaaS based Reconciliation and Data Management platform, Reconsyde, empowers organization by ensuring streamlined processes, enhanced analytics, and personalized solutions for robust financial management.

Without proper reconciliation tools and automation, organizations struggle to keep up with the increasing volume and complexity of data.

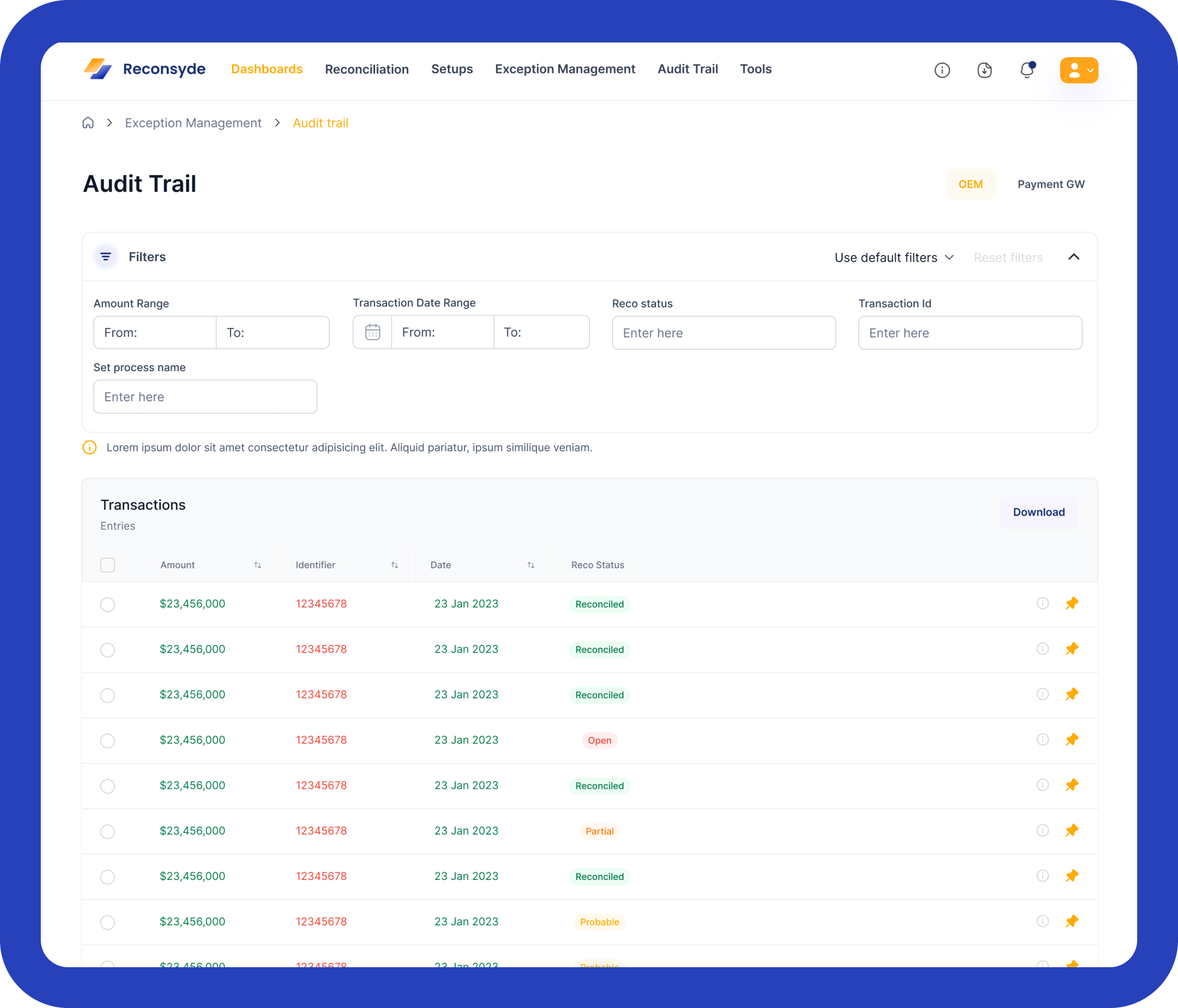

Meticulously logs all activities, ensuring complete transparency and accountability in the reconciliation process.

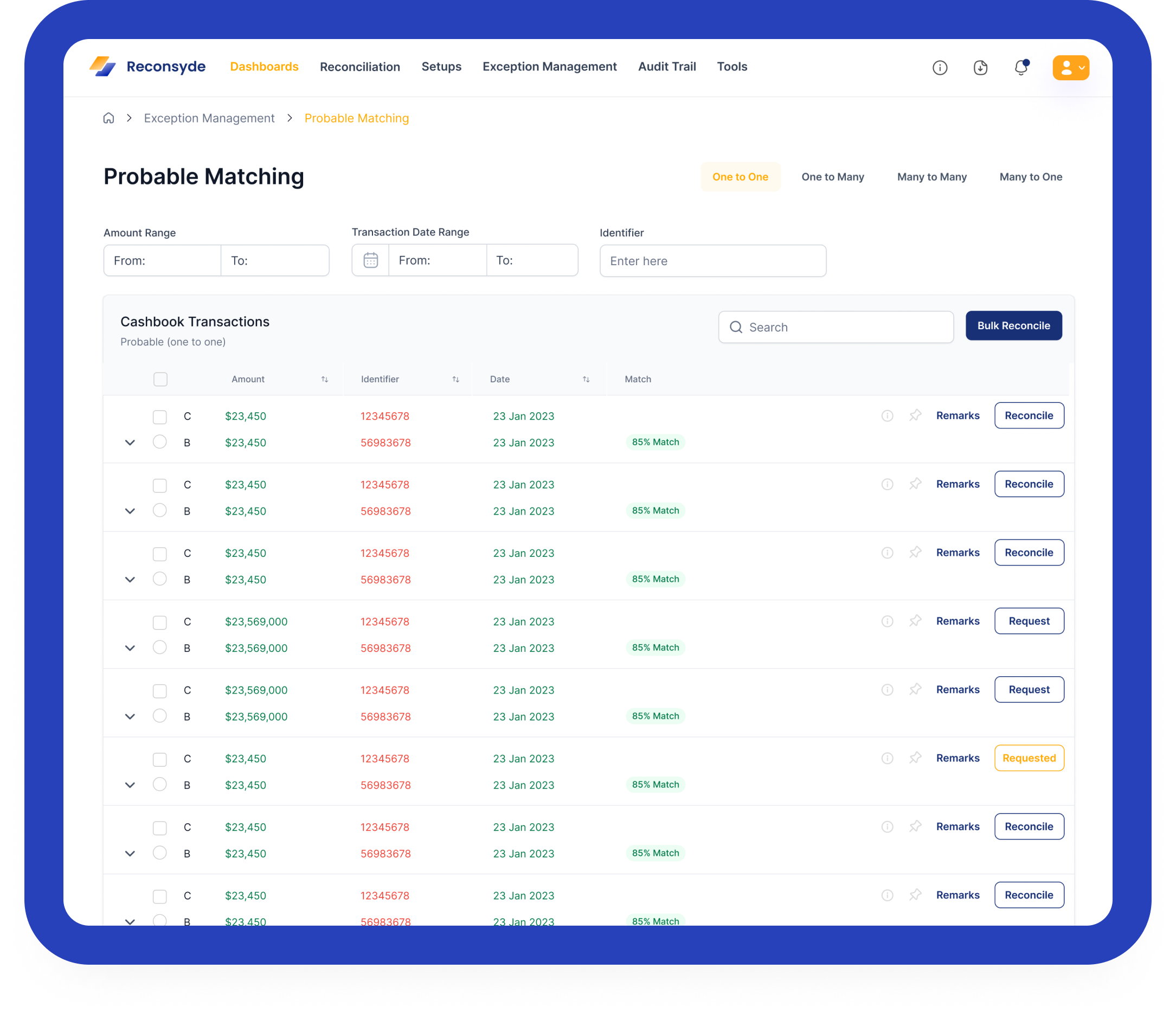

Intuitive exception management tools easily tracks and resolves discrepancies, minimizing delays and improving efficiency.

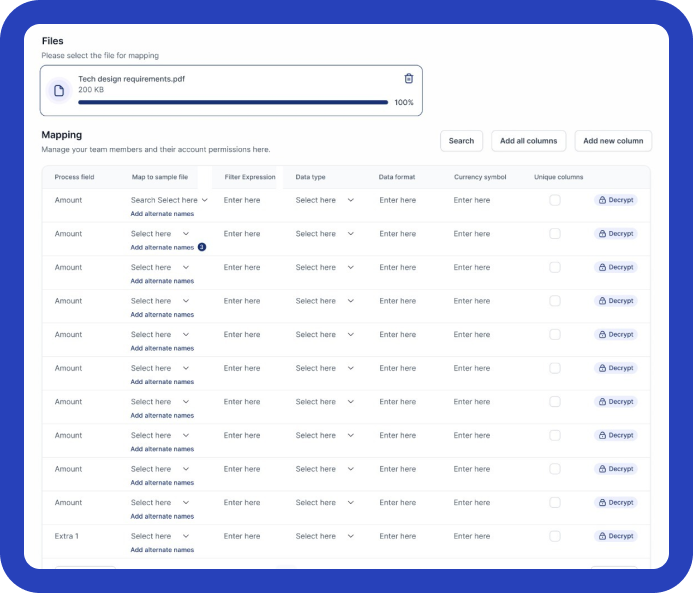

Robust data security protocols safeguards and protects against unauthorized access of financial information.

Industry-leading encryption techniques guarantees confidentiality and integrity of data during transmission and storage.

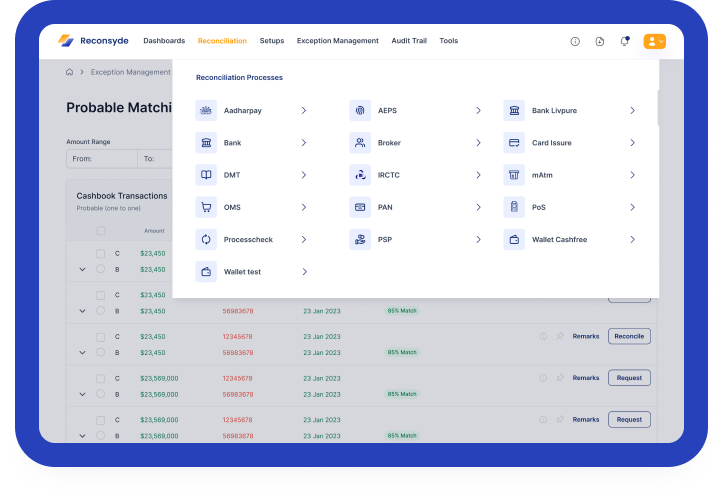

Streamlines entire reconciliation process, ensuring seamless execution and accurate outcomes through:

Equipped with diverse range of pre-configured reconciliation processes, tailored to meet specific needs, the processes include:

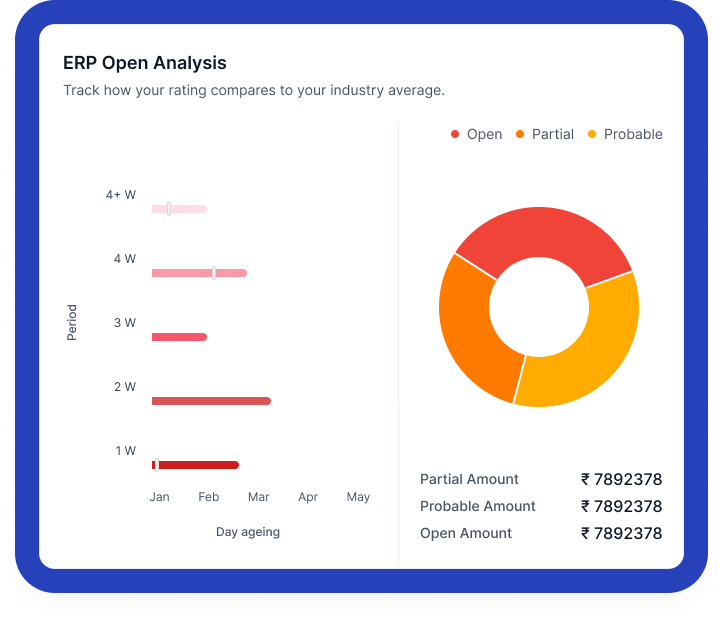

Providing data-driven insights and empowering your decision-making through:

Unlock unparalleled precision with our Advanced Charges/Commission Calculator. Engineered for accuracy and efficiency, this cutting-edge tool seamlessly computes intricate charge structures and commission rates, accommodating diverse scenarios and multi-tiered agreements.

Whether you're dealing with simple percentage calculations or complex, conditional rate determinations, our calculator delivers rapid, error-free results every time. Intuitive and user-friendly, it's the ultimate solution for businesses aiming for transparent, accurate, and streamlined financial operations.